Autumn Budget 2025: What Property Professionals Need to Know

- B Johnstone

- Dec 5, 2025

- 4 min read

The most consequential property budget in recent memory has arrived.

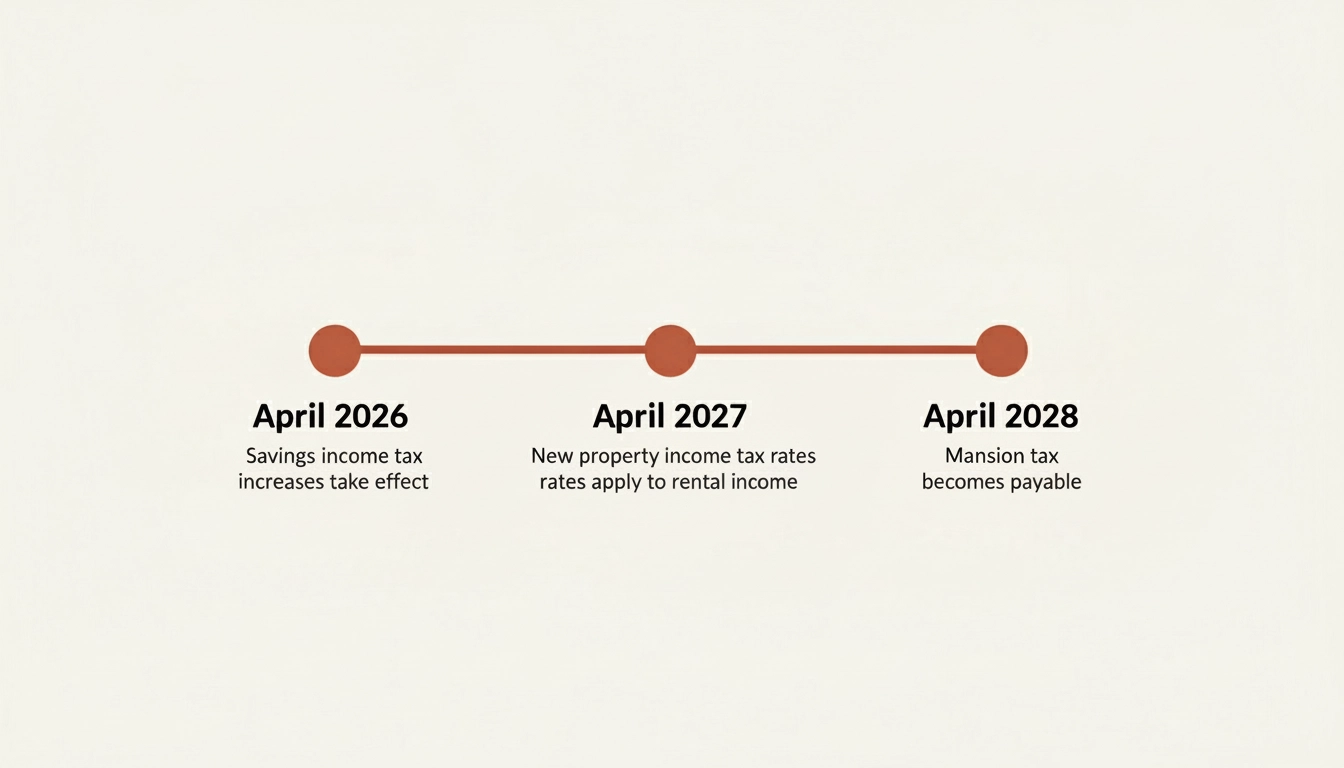

Chancellor Rachel Reeves' Autumn Budget 2025 is shaping up to be a watershed moment for UK property professionals, introducing changes that will fundamentally alter how high-value properties are taxed and how rental income is treated across England, Wales, and Northern Ireland.

You may be asking: what does this mean for your clients, your deals, and your business? The landscape is shifting beneath our feet, and understanding these changes isn't just advisable: it's essential for survival in an increasingly complex market. So, what exactly do property professionals need to know about the Autumn Budget 2025 - read on to discover exactly what's coming and when.

The Mansion Tax: A £2 Million Threshold That Changes Everything

The headline-grabbing introduction is undoubtedly the High Value Council Tax Surcharge: effectively a mansion tax that will reshape the luxury property market from April 2028. This isn't speculation anymore; it's confirmed policy that will impact every property valued at £2 million or above.

The tiered structure is more nuanced than many anticipated:

£2.0–2.5 million: £2,500 annual surcharge

£2.5–3.5 million: £3,500 annual surcharge

£3.5–5.0 million: £5,000 annual surcharge

£5 million+: £7,500 annual surcharge

What's particularly significant is that this tax falls on the property owner, not the occupier: a crucial distinction that will influence how high-value properties are structured and held. The government will conduct targeted valuations every five years, creating ongoing uncertainty about which band properties will fall into.

Current market dynamics are already reflecting this impending change. Sales of properties exceeding £2 million have declined 13% year-on-year, suggesting the market has been pricing in this risk well before the official announcement. With less than 0.5% of all home sales currently agreed above this threshold, you might think the impact is limited: but the psychological effect on the luxury market continues to evolve.

For property professionals, this creates both challenges and opportunities. High-net-worth clients will need sophisticated advice on timing transactions, restructuring ownership, and understanding the long-term cost implications of luxury property ownership.

Landlords Face a Double Hit on Rental Returns

The buy-to-let sector is facing potentially its most challenging period yet, with rental income taxation becoming significantly more onerous from April 2027. An additional 2% increase in income tax on rental income will push rates to:

Basic rate: 22% (up from 20%)

Higher rate: 42% (up from 40%)

Additional rate: 47% (up from 45%)

This represents a substantial erosion of net rental yields at a time when many landlords are already grappling with increased compliance requirements, mortgage rate volatility, and evolving tenant rights legislation.

The timing couldn't be more challenging for portfolio landlords who've been banking on rental income growth to offset recent mortgage rate increases. You may be wondering how this will impact investment appetite... the answer is likely to be significant portfolio consolidation and a flight towards higher-yielding opportunities.

For property professionals advising landlord clients, the message is clear: the era of straightforward buy-to-let returns is definitively ending. Sophisticated investors are already exploring alternative structures, including corporate ownership vehicles and joint venture arrangements that might offer more tax-efficient approaches to property investment.

Commercial Property: A Tale of Two Markets

Business rates reform is creating winners and losers in the commercial sector. Properties with rateable values of £500,000 or more: representing approximately 1% of all commercial properties: will face a higher rate set 2.8p above the national standard multiplier.

However, this is balanced by permanently lower rates for retail, hospitality, and leisure properties, worth nearly £900 million annually. The retail, hospitality, and leisure multipliers will sit 5p below their national equivalents, providing much-needed relief to sectors that have faced unprecedented pressure.

This divergence is creating a two-tier commercial property market where location, use class, and rateable value will determine taxation burden more dramatically than ever before. High-value office developments and premium retail spaces will face increased holding costs, while smaller hospitality and retail operations receive meaningful relief.

What Didn't Change: Stamp Duty Stability

Contrary to months of speculation, stamp duty rates and thresholds remain completely unchanged. This provides some stability in an otherwise shifting landscape, offering property professionals and their clients at least one area of certainty when planning transactions.

The decision to leave stamp duty untouched likely reflects recognition that further transaction cost increases could severely impact market liquidity. With transaction volumes already under pressure from elevated mortgage rates and economic uncertainty, additional stamp duty burdens could have proven economically counterproductive.

The Broader Investment Context: Savings and Future Consultations

From April 2026, savings income taxation increases by 2% across all bands, rising to 22%, 42%, and 47% respectively. While this doesn't directly impact property transactions, it influences how property investors structure their cash reserves and may drive additional capital towards property as an alternative to traditional savings products.

Several consultations are shaping up to further influence the property landscape:

Tourism taxes for regional mayors, potentially affecting serviced accommodation and hospitality investments

Social housing VAT reform to incentivise development of affordable housing

Lifetime ISA changes specifically designed to help first-time buyers access properties over £450,000

These consultations suggest the government's property tax agenda extends well beyond this budget, with further changes potentially emerging throughout 2026 and 2027.

Autumn Budget 2025: Preparing for the New Reality - what you need to know

The challenging yet exciting space that property professionals now navigate requires immediate strategic thinking. Client conversations should focus on:

For luxury property clients: Timing considerations for transactions approaching the £2 million threshold, potential restructuring of ownership vehicles, and long-term cost analysis incorporating annual surcharges.

For landlord clients: Portfolio review and potential restructuring, consideration of corporate ownership vehicles, and yield recalculation incorporating higher taxation.

For commercial property investors: Understanding the new business rates landscape and how use class and rateable value will determine future holding costs.

The property market is entering a period of fundamental change, but with challenge comes opportunity. Those who adapt quickly and advise clients effectively will emerge stronger in this evolving landscape.

For comprehensive support navigating these changes and accessing sophisticated property funding solutions, explore our resources at PropFundrs or connect with our community of property professionals who are successfully adapting to this new environment. Or alternatively, click the link below to book a call with our team members:

Comments